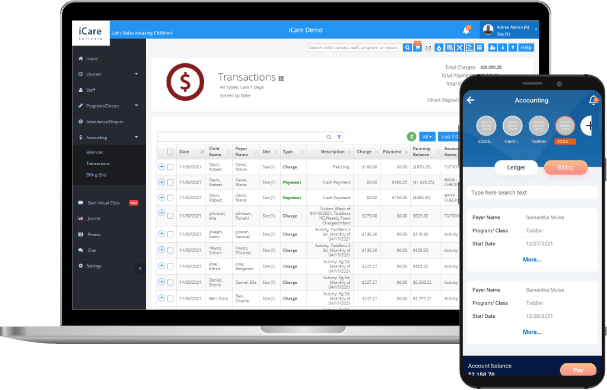

Accounting & Financials

Childcare center accounting is a laborious process, especially if you are on an operational and financial tightrope.

Let iCare Software help you manage the day-to-day operations of your child care center. In addition to our functionalities, we provide mobile apps so you can get real-time information about your business on the go.