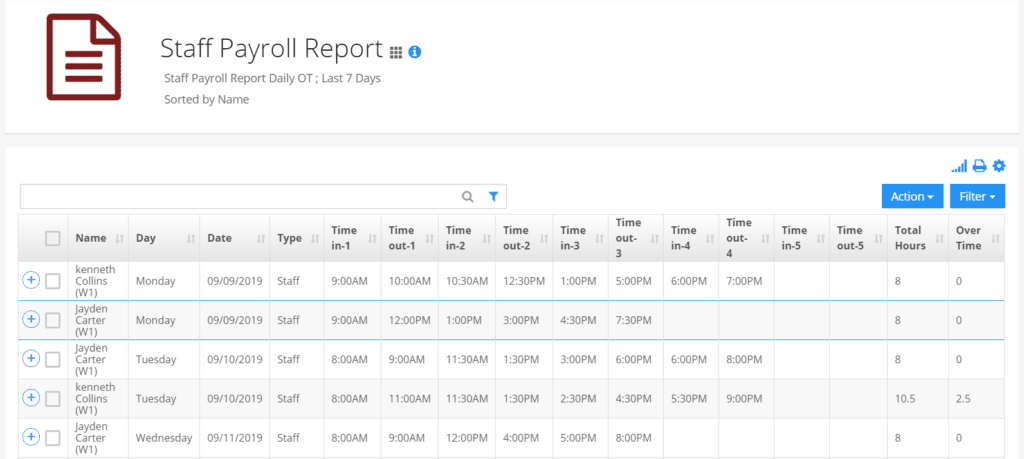

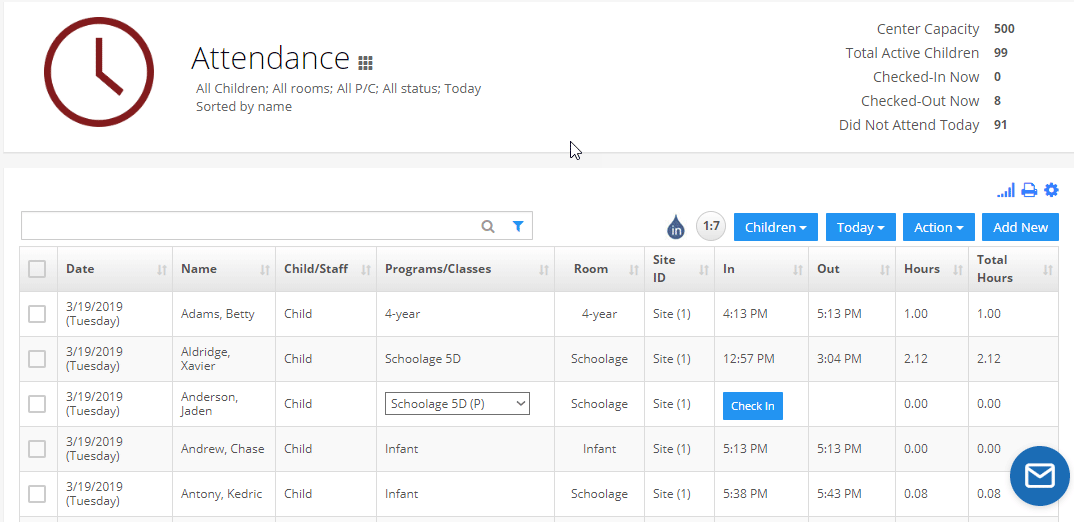

Reporting

Save time and effort with effective reporting.

Take the hassle out of managing your everyday work with reports and automated alerts and notifications.

iCare's Reporting has over 60 out-of-the-box center reports for all areas of your early childcare development center.

The built-in reporting tools let you edit, find sort, print, email, or individual and batch actions.

You can easily add a custom report in any of the report areas – like children, accounting, child enrollment, billing and class, and program attendance, etc. Analyze data from all areas of your business so you can grow and improve your childcare center.

Go to the Report Center and click on Add Custom Report and state in simple English what you need the report for and what information it should provide.

Yearly Tax Statement for parents.

Formatted account statement for printing or emailing.

Deferred deposits (escrow account) balances.

Billing totals grouped by date and revenue account.

Deferred deposits (escrow) ledger.

General Ledger: All RL transactions are posted in the GL using the double entry system. This makes it possible to export revenue numbers for journal entry in a financial accounting package.

Chart of Accounts: The default accounts in the COA are:

iCare accounting reports include the Yearly Tax Statement for the parents. Parents can view and print it themselves or an admin can email to them or print it for them.

The Tax Statement is prepared on cash-basis. It is the total of all the payments minus refunds posted in the calendar year. It is not an accrual report, i.e., it is not based on posted charges and credits.

The Statement included the centeru2019s Tax ID and is ready for use for a parentu2019s tax return.

Learn how childcare software can be an investment in growing and improving your bottom line.

Copyright 2024 – iCare Software | Service Agreement | Privacy Policy | HIPAA BAA